Original Article & Image: FHL Bank San Francisco

http://www.fhlbsf.com/resource-center/spotlight/idea-huertas.aspx

Maria and Mauricio Huerta came to America from Mexico 32 years ago for the same reason most immigrants do: the chance to have a better life. Mauricio worked in a warehouse and Maria as a nurse’s aide, and the couple lived in rented apartments for a long time. But they always dreamed of owning a house – some place that was private and just for them, where the rent wouldn’t keep increasing. In 1995, they were able to buy a small house near family members in Stockton, California, and lived there for 10 years.

With the arrival of a new baby daughter, in 2005 the couple felt it was time for a bigger house. Home prices were high then, but, like most people did at the time, the Huertas believed that prices would only go higher, justifying the big investment they were making and mitigating the potential risks of an adjustable rate mortgage. So they weren’t afraid to transfer all the equity the family had built up with their small house into a larger home.

“The payment went up and up and up, it was so fast and so hard. We ended up losing everything.”

Maria Huerta, Lease-to-Own Participant and IDEA Grant Recipient

Six years later, while the housing bubble continued bursting all around them, Mauricio got sick and couldn’t work for a time and Maria’s income alone was not enough to support the mortgage. “The payment went up and up and up, it was so fast and so hard,” Maria says. “We ended up losing everything.” After the foreclosure, the Huertas – Maria, Mauricio, and their young daughter Jenny – had no choice but to move in with relatives.

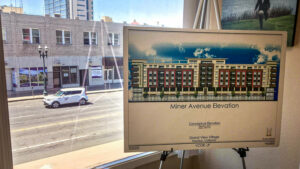

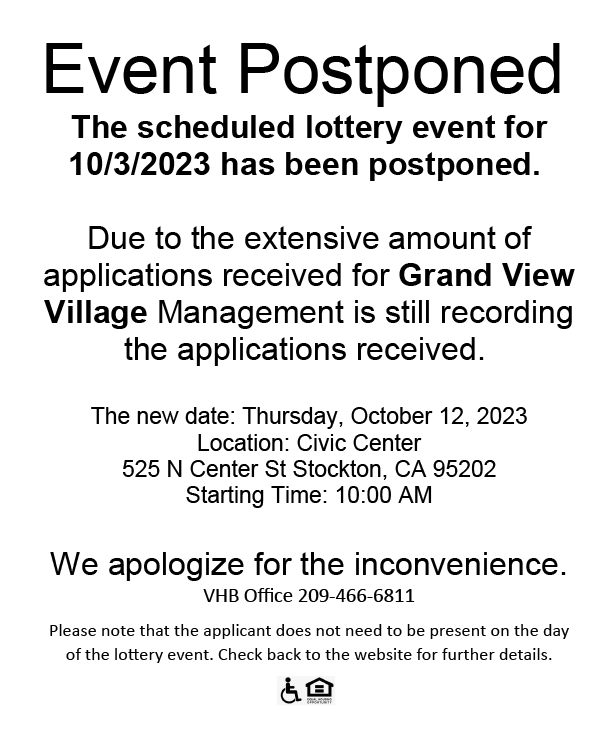

The Huerta’s experience was not an uncommon one in the Stockton area, which was recognized as the foreclosure capital of the country following the financial crisis. While the family was living with her sister, Maria happened to see José Nuño in a television commercial, promoting Visionary Home Builders of California’s “Bounce Back to Homeownership” lease-to-own program, created in response to the foreclosure crisis. Maria was excited to hear Mr. Nuño, Vice President of Programs and Services at VHB, describe an alternative path to homeownership. It was an opportunity to develop a plan to repair their damaged credit, establish a reasonable household budget, and save for a downpayment, all while living in the home they would ultimately purchase.

Maria and Mauricio seized the opportunity to reclaim their dream of having a home of their own. They enrolled in the lease-to-own program and moved into a 3-bedroom house in VHB’s brand new “Land of the Sun” development, determined to achieve their goal of becoming homeowners again in a way that would be sustainable for the long run.

“This family knew what they had to do, they weren’t here to play.”

José Nuño, Executive Director, Vice President of Programs and Services, Visionary Home Builders of California

At its core, the Bounce Back to Homeownership program is about financial education. “We notice that a lot of families tend to do ‘mental accounting,’” José says. “But when you put it on paper, then you can really see where the money is going.” Program participants must complete classes taught by HUD-certified counselors and are required to have quarterly visits with a housing counselor, through which they are able to set reasonable goals and track their own progress on credit repair, household budgeting, and saving for a downpayment. “There are a lot of requirements,” Maria says. “It’s a long process and a lot of work, but it’s worth it—it’s a really good deal.”

But for committed lease-to-own participants, like the Huertas, there can also be great rewards for all that hard work. As an incentive for consistently paying rent on time, VHB gets the ball rolling by putting $100 from every rent payment into a savings account for the homebuyer. Then, on top of that, the aspiring homebuyers can enroll in the Federal Home Loan Bank of San Francisco’s Individual Development and Empowerment Account (IDEA) homeownership program, which matches $3 for every $1 the homebuyers are able to save toward a downpayment. “I told Maria and Mauricio, if you do this, it will be a win,” says José. “And they met the challenge and saw the win.” By making regular deposits for more than three years the Huertas saved $5,000, and received the maximum IDEA grant of $15,000.

IDEA grants are delivered to homebuyers through the Bank’s member financial institutions. In this case, the participating member was MUFG Union Bank. “We have enjoyed a long-standing relationship with the Federal Home Loan Bank of San Francisco through their other community programs, but in the case of the Huertas we were especially pleased to use the IDEA program for the first time,” said Bobbie Salgado, Director of CRA Strategy & Operations at Union Bank. “With IDEA matching grants, homebuyers in a lease-to-own program like the one that VHB offers can take pride in their own self-reliance as they work toward the purchase of their home.”

The Huertas hope to pay off the house entirely before they retire, and they can’t imagine a reason they would ever leave. Maria notes how lucky the family is to have recovered from the foreclosure–she knows many people who have not and remain discouraged. By contrast, what they have learned in this process about homeownership and managing their finances allows them to feel confident about the future. “Financially it feels good, and I feel comfortable,” says Mauricio. “I can sleep in peace.”